Salman, associates default on Tk 18,000cr loans

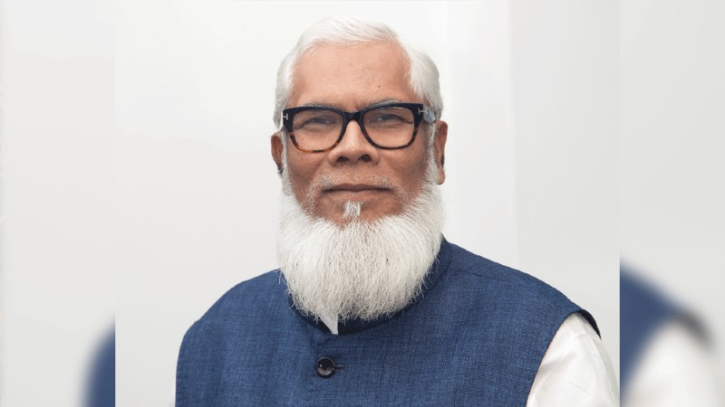

Deposed prime minister Sheikh Hasina’s former adviser for private industry and investment Salman F Rahman and his associated companies have defaulted on around Tk 18,000 crore loans from Janata Bank, according to data from Bangladesh Bank and Janata Bank.

The loans, which belong to Beximco Group, a family business of Salman F Rahman, became classified after the group failed to repay in stallments and interest.

Salman F Rahman is a controversial figure, accused of exerting undue influence over the stock market and banking sector to maximise his own benefits.

The group had withdrawn approximately Tk 25,000 crore in funded and non-funded loans, including Export Development Fund loans, from Janata Bank.

Out of this amount, Tk 18,000 crore became classified due to non-payment.

The companies associated with Salman and his family members have taken more than Tk 45,000 crore in loans from eight different banks.

Salman F Rahman serves as vice-chairman of Beximco Group.

The data reveals that Beximco Group secured about Tk 25,000 crore from Janata Bank in the name of around 28 companies, most of them are little-known garment companies.

Due to the central bank’s refusal to reschedule these loans, Tk 18,000 crore of this amount has turned bad.

Janata Bank chairman Mahfuzur Rahman told New Age that the group’s loans were taken over a long period of time and increased significantly after 2015.

He stated that the Tk 18,000 crore became classified after the group failed to meet its repayment commitments, despite repeated warnings from the bank.

Mahfuzur also said that Janata Bank had stopped providing new loans to the group due to their high non-performing loan figures, and the efforts are underway to recover the debt.

Salman’s company, Esses Fashions Limited, also failed to repay $24.4 million in loans from the Export Development Fund, leading to his son being removed from the board of IFIC Bank due to the default.

In addition to Janata Bank, Salman and his associates have borrowed Tk 11,000 crore from IFIC Bank, where Salman also serves as chairman.

Other loans include Tk 1,838 crore from Sonali Bank, Tk 965 crore from Rupali Bank, Tk 1,409 crore from Agrani Bank, Tk 2,952 crore from National Bank, Tk 661 crore from EXIM Bank, and Tk 605 crore from AB Bank.

Most of these loans were reportedly taken without adequate collateral, raising concerns about recoverability.

BB executive director and spokesperson Mezbaul Haque stated that the central bank would investigate all irregularities and defaulted loans and would take action based on the findings of these investigations.

The loans remained unclassified for years through multiple reschedulings, despite being overdue.

In 2016, Bangladesh Bank introduced a special loan rescheduling facility allowing defaulters to regularise their loans for 10 years by paying just a 2 per cent down payment, a policy reportedly influenced by Salman F Rahman.

In 2022, the policy was further relaxed, allowing defaulters to repay their loans over 29 years.

In 2022 alone, a record Tk 63,720 crore in loans was rescheduled, up from Tk 26,810 crore in 2021.

On Tuesday evening, Salman F Rahman and former law minister Anisul Huq were arrested at Dhaka River Port in the Sadarghat area as they attempted to flee via the river.

The Dhaka Metropolitan Magistrate Court placed both of them on 10-day remand in connection with a case related to the murder of hawker Shahjahan Ali, filed with the New Market police station.