Thrust for bringing char dwellers under financial inclusion to help change their lots economically

Speakers in a function here today thrust for bringing the char dwellers under state run facilities including financial inclusion to help change their lots economically.

The people of chars are deprived off formal financial services. That is why, they are backward. Desired development was not achieved for them. As the char people are the citizens of the state, they deserve to enjoy the formal banking facilities like the people of the mainland. So, an emphasis should be given to bring the char people under the mainstream of development to build happy, prosperous, Smart Bangladesh by 2041, a farsighted vision of Prime Minister Sheikh Hasina”, they also said.

They came up with the comments while they were addressing a daylong program on financial inclusion for the char people at SKS Inn located at Radha Krishnapur area under Boali union of Sadar upazila in the district this morning.

CARE Bangladesh arranged the program under Strengthening Household Ability to Respond to Development Opportunities (SHOUHARDO) III Plus activity, funded by donor agency United States Agency for International Development (USAID).

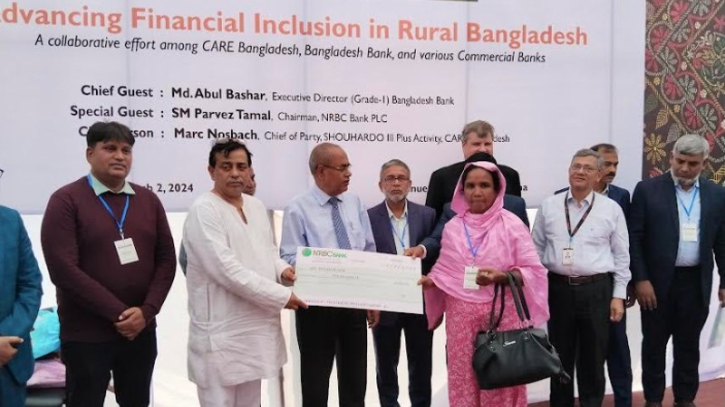

Md. Abul Bashar, executive director of Financial Inclusion Department of Bangladesh Bank addressed the function as the chief guest and SM Parvez Tamal, chairman of NRBC Bank PLC, spoke at the event as the special guest while Marc Nosbach, Chief of Party of SHOUHARDO III Plus activity presided over the ceremony.

Representatives of CARE Bangladesh, Bank Asia, Madhumati Bank, and Mutual Trust Bank spoke at the event, among others.

Earlier, a presentation on overall activity of the program was made by Mannan Mazumder, Sr. Team Leader, SHOUHARDO III Plus Activity.

Chief guest Md. Abul Bashar in his speeches said Village Saving and Loan Association (VSLA) model facilitated by CARE Bangladesh is a strong platform for expediting the financial inclusion of the rural poor.

He also put emphasis on financial literacy, properly use of loan for income generation to change the lots of the loan receivers and to accelerate the financial inclusion side by side with finding potential young entrepreneurs especially women entrepreneurs along with poor people living in chars here for bringing them under the financial support of commercial banks.

Jahura Khatun, one of the loan beneficiaries, expressed her feelings saying that she never thought of opening a bank account by depositing TK 10. She received an amount of loan from a bank with less interest without any hassle she said adding that she would utilize the loan aimed at increasing her family income.

Answers to the question raised by the participants were also given by the guests during the open discussion of the function.

Later, loans for 16 members of VSLA were disbursed in the function.

Marc Nosbach, Chief of Party of SHOUHARDO III Plus, in his speeches said this collaboration would relieve the char people particularly the poor women from the vicious loan cycles of moneylenders and other financial service providers with high-interest rate.

He also thanked all for participating in the event spontaneously.

Representatives of women coming from activity command areas, officers of partner organizations, field-level officers of commercial banks, and inviter persons including journalists from print and electronic media were present on the occasion.